Personal Loans

Personal Loan is associate unsecured loan for private use that doesn't need any security or collateral and may be availed for any purpose.

Welcome to Konark Commercial Ltd, experts in risk-free

loans with easily understood terms. We offer personal

loans, business loans, home loans, and loans against

properties throughout different regions of India.

Our mission is to provide swift and easy borrowing

options alongside the most competitive rates in the

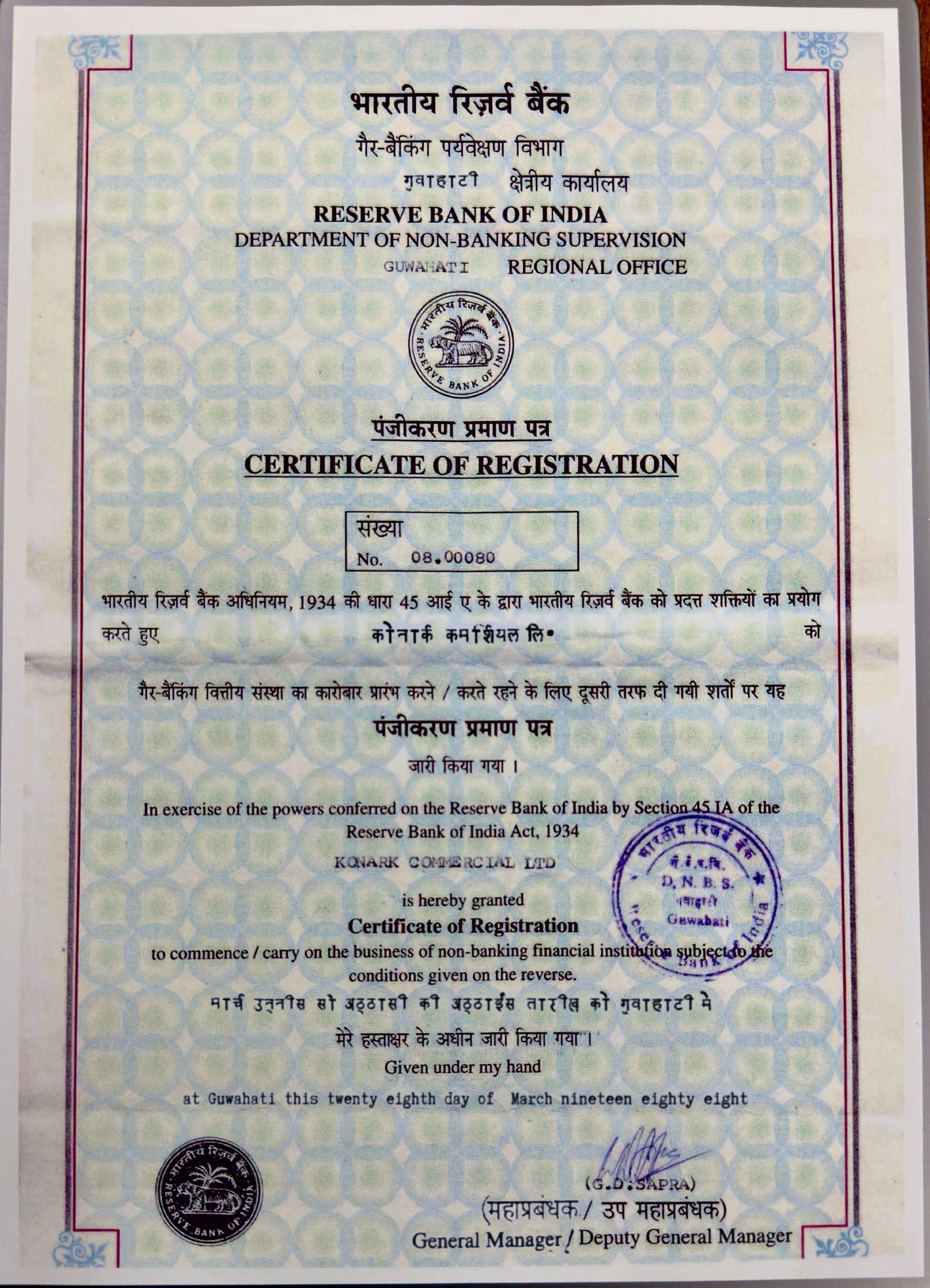

industry, made possible by our long-standing

relationships with top-tier banks and non-banking

financial companies (NBFCs). With years of experience in

the financial services industry, we guarantee the most

affordable rates, easy documentation, and quick

approvals.

We offer tailored guidance throughout the entire process

because we know that everyone has different financial

goals. Be it funding your business, managing a crisis,

or realizing personal milestones, we ensure specialized

consultation for every client.

We offer a loan for different purposes so that a personal loan amount can be used for multiple purposes. You can choose a loan per your requirements and where you want to use it. So, we provide loans for different purposes as follows.

Personal Loan is associate unsecured loan for private use that doesn't need any security or collateral and may be availed for any purpose.

Business loan is a financial product designed to provide funding to businesses for various purposes, such as expansion, working capital, equipment purchase, or inventory management.

Konark Commercial Ltd offers loan against property for fulfilling personal needs such as meeting expenditure on education, marriage, healthcare etc.

Annual percentage rate (APR) is determined based on your credit score, the amount you wish to borrow and your steady income. Generally, a good CIBIL score calls for a low APR while a poor CIBIL score means high APR. But we have a fixed APR which is the same for all.

APR reflects the true cost of borrowing money. It includes the annual interest rate, a nominal processing fee and other miscellaneous expenses. APR is usually lower than your credit card interest rate. APR is the actual annual cost of your loan that helps you compare various loan offers from different lenders. We have a fixed APR @ 33.6% per annum.

| Tenure | Loan Amount | Interest Rate | Admin Fees | APR | Amount Deposite | EMI | Total Interest |

| 12 Months | Rs.1,00,000 | 2% | Rs.1000 | 24% | Rs. 99000 | Rs. 9456 | Rs.13472 |

Calculate your total repayment based on loan amount, tenure, and interest rate.

Total Payable: ₹ 0